Global markets experienced a tumultuous trading day on Monday, ignited by former U.S. President Donald Trump’s renewed commitment to his aggressive tariff strategy. This seismic shift began in the Asia-Pacific region, where stock markets saw a dramatic plunge, reminiscent of past economic crises. The ripple effects were felt across Europe and into the United States, causing widespread financial anxiety and market instability.

Asia-Pacific Markets Lead the Plunge

The trading day commenced in the Asia-Pacific region, where investors were met with an unexpected shock. Stock markets across major Asian economies, including Japan, China, and South Korea, witnessed a sharp decline. This drop was triggered by Trump’s announcement of additional tariffs on Chinese goods, part of his ongoing trade war rhetoric. The Nikkei 225 in Japan fell by 3.5%, while China’s Shanghai Composite Index dropped 4.2%, marking one of the steepest declines in recent memory.

Market analysts attributed the decline to investor fears over escalating trade tensions between the world’s two largest economies. “The uncertainty surrounding these tariffs is causing panic among investors,” said Hiroshi Tanaka, a Tokyo-based market strategist. “There’s a growing concern about the potential impact on global supply chains and economic growth.”

European Markets Follow Suit

As the European markets opened, the negative sentiment from Asia quickly spread. Major indices, including the FTSE 100 and Germany’s DAX, opened sharply lower, reflecting the global apprehension. By midday, the FTSE 100 had fallen 2.8%, while the DAX experienced a 3% decrease. The European Central Bank (ECB) issued a statement expressing concern over the potential long-term effects of the tariffs on the European economy.

Economic experts in Europe highlighted the vulnerability of the continent’s export-driven economies. “Europe is heavily reliant on international trade, and any disruption in global trade flows can have severe consequences,” noted Claudia Weber, a senior economist at the ECB. “The tariffs could lead to higher costs for European exporters and disrupt established trade relationships.”

U.S. Markets Brace for Impact

By the time U.S. markets opened, the stage was set for a volatile session. The Dow Jones Industrial Average dropped over 500 points within the first hour of trading, while the S&P 500 and Nasdaq Composite also saw significant losses. Wall Street analysts pointed to investor concerns over the broader implications of the tariffs on U.S. businesses and consumers.

“These tariffs are essentially a tax on American companies and consumers,” said Mark Williams, a senior analyst at a leading investment firm. “The increased costs could lead to higher prices for goods and services, ultimately affecting consumer spending and economic growth.” The U.S. Chamber of Commerce echoed these sentiments, urging the government to reconsider its tariff strategy in favour of more constructive trade negotiations.

Global Economic Outlook

The global economic outlook remains uncertain as markets continue to grapple with the implications of the tariffs. Economists warn of potential slowdowns in economic growth, particularly if the trade tensions persist. The International Monetary Fund (IMF) has already revised its global growth forecasts, citing the trade war as a significant risk factor.

“The ongoing trade disputes pose a substantial risk to global economic stability,” stated Christine Lagarde, Managing Director of the IMF. “We urge all parties involved to seek amicable solutions through dialogue and negotiations to prevent further economic disruptions.”

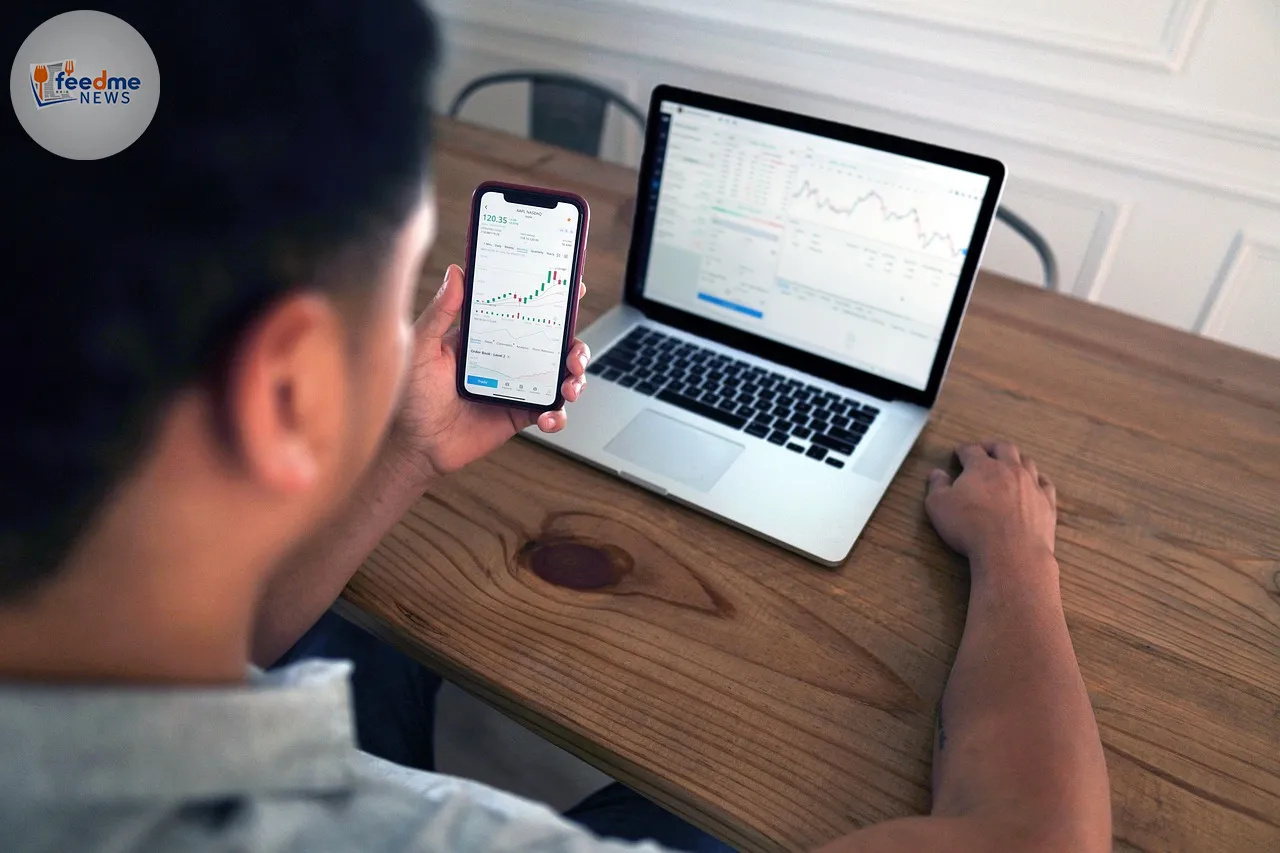

Investor Reactions and Future Prospects

Investors worldwide are now closely monitoring developments in the trade dispute, with many adopting a cautious approach to future investments. Hedge funds and asset managers are reassessing their strategies, considering the potential for further market volatility. “We are advising our clients to remain vigilant and diversify their portfolios to mitigate risks,” advised Sarah Chen, a portfolio manager at a leading investment firm.

The potential for further escalation in the trade war looms large, with analysts predicting continued market volatility in the coming weeks. As global leaders prepare for upcoming trade negotiations, the stakes remain high, with the potential for significant economic repercussions.

In summary, Monday’s market turmoil underscores the fragility of the global economy amidst escalating trade tensions. Investors and policymakers alike are urged to prioritise dialogue and cooperation to navigate these uncertain times. The world watches closely, hoping for resolutions that will restore stability and confidence in global markets.